ThreeSixty Research Market Update March 2014

FEBRUARY MARKET PERFORMANCE

Global economies

The February global Purchasing Managers Indices (PMI), including both manufacturing and services data, has shown more synchronised global growth.

The US data has shown indications that the impact from the severe weather conditions over recent months is subsiding.

The Eurozone recovery is broadening to include the smaller peripheral nations, albeit at modest growth rates.

Despite recent weaker February manufacturing and export data, China continues to rebalance their economy and is targeting a 7.5% GDP growth rate in 2014.

Australia’s non–mining parts of the economy are showing positive signs with residential construction on the increase.

US

In the US, GDP grew at an annualised rate of 2.4% in the fourth quarter, 2013 This was down from the 4.1% growth in the third quarter. Extreme weather conditions in the US gave reason for weaker data over the previous quarter – and we continued to see the cold weather impair manufacturing production in January and February.

A decline in Government spending accounted for 1% of the decline in GDP. However, there have been some encouraging signs from recent data that the worst of the impact is behind the economy. In this regard, February factory orders improved from its eight month low, while the January consumer spending data also showed positive signs.

Although unemployment in February rose to 6.7% (6.6% in January), job creation expressed through the non-farm payrolls data increased to 175,000, well ahead of the previous two months data.

There was also muted pricing pressure in January. Inflation, excluding food and energy, was only up 1.1% (yoy) and remains subdued and well below the Federal Reserve target inflation of 2%.

Europe

Over in Europe, January unemployment in the Eurozone remained at record highs of 12%.

Inflation in the Eurozone, was 0.8% in February, the same as December and January, easing some of the deflationary concerns that have existed in recent months. Although inflation remains low and some risk of deflation exists, Mario Draghi, President of the European Central Bank (ECB), does not consider deflation to be a likely probability. This has eased the likelihood of the ECB providing further economic stimulus.

The February business growth data for the Eurozone suggested the region’s economy is on course to grow by 0.4-0.5% in the first quarter of 2014. In February, private businesses enjoyed the fastest growth rate in over two and a half years.

Although Eurozone manufacturing slowed in February, the service sector actually improved. The German manufacturing data was particularly strong, recording a 33 month high. Although France continues to struggle, Italy and Spain both had strong growth.

Interestingly, retail sales across the Eurozone rose by 1.6% in January.

China

China has set an economic growth target of 7.5% for 2014 and reaffirmed its inflation target of 3.5%. The economy grew at 7.7% in 2013, the slowest rate since 1999 but consistent with the desire to rebalance the economy.

The Government focus remains on tightening fixed asset investment as well as controlling credit growth, particularly in the property related sectors. The Government will target 17.5% annual growth in fixed asset investment and 14.5% retail sales growth in 2014.

China has also indicated that they will push forward with the reform of the Yuan in 2014.The budget deficit in 2014 is forecast to represent 2.1% of GDP.

China's services sector regained some momentum in February but the manufacturing sector struggled, with this divergence adding to the difficulty in assessing the strength of the economy at the start of 2014. The non-manufacturing PMI rose to a three month high in February, while the manufacturing data went the opposite way and recorded its third straight monthly decline.

The seasonal impact associated with the Lunar New Year holiday period traditionally has an impact on the flow of economic data and this year has been no exception. Weaker exports, investment and manufacturing PMI were evident in February.

Asia region

Japan’s GDP growth grew 1% in Q4 2013 and at an annualised rate of 1.8% (yoy). Although the data was weaker than expected, the annualised rate is still an improvement over the 1.6% in 2013. The data represented the fourth consecutive quarter of positive growth.

Since Japan announced their massive stimulus program in April 2013, the Japanese Yen has fallen approximately 27%. Although the weaker Yen has improved corporate earnings as exports have improved, import costs have also increased. The higher fuel costs have also increased as a result of the reduction of nuclear power following the Fukushima crisis. As a result, Japan has had a persistently high trade deficit.

Consumer spending was up in February, ahead of the planned April increase in the consumption tax rate from 5% to 8%. Retail sales grew 4.4% in January compared to a year ago, representing the sixth straight month of gains. Similarly, industrial production was up 4% in January.

Core consumer prices have also risen 1.3% (yoy) in January. This reflects the continued positive economic signs and a move away from the long deflationary period for the Japanese economy. Importantly unemployment remained steady at 3.7%.

Australia

Back at home, the RBA, as expected, kept the cash rate unchanged at the March meeting. The RBA has retained its neutral stance. Better consumer demand has improved the prospects for housing construction and business conditions, while exports have also improved.

Inflation is consistent with a 2-3% target range, although some upside risk is evident in the RBA forecasts over the next 18 months.

Unemployment is still expected to rise further before it peaks at around 6.5%.

Retail sales in January rose 1.2%, the ninth consecutive increase in retail sales. This represents a 6.2% annualised increase.

Building approvals rose 6.8% in January, with a 8.3% rise in private housing approvals and a 4.6% rise in apartments. The level of approvals in January was the highest monthly rise since 2002.

House prices have steadied over the past month – the 5 capital city house prices down marginally at 0.08% with Sydney the only city where house prices increased (+0.69%). Year on year, the 5 capital cities growth has been 9.65%, with Sydney increasing 14.01% and Melbourne up 10.03%. The average price increase has been 1.12% in 2014. An interesting statistic is the increase off the trough in prices – the 5 capital city prices are up 13.7% with Sydney leading the way with an increase of 19.3%.

Although some pick-up in non-mining spending is occurring, it is unlikely to be sufficient to replace the drop off in mining capital expenditure.

The RBA interest rate strategy is on hold at the moment. However, given the relatively poor capital expenditure outlook, the prospect of higher unemployment in the near term, and the prospect of a stabilisation in house price growth as the year progresses, the RBA has flexibility to lower interest rates if necessary.

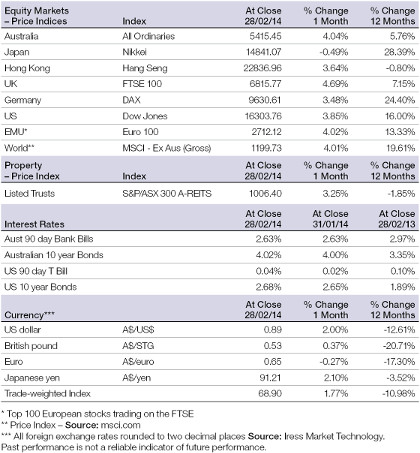

Equity markets

|

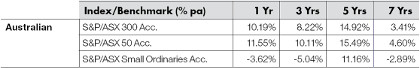

Australian Equities

After a disappointing start to the year, the weak Australian equity market performance in January was followed by a significant improvement in February. The S&P/ASX 300 Accumulation Index had a strong performance in February, increasing 4.92%.

The S&P/ASX All Ordinaries Index was also up in February, posting a strong return of 4.04%.

For the 12 months to 28 February 2014, the S&P/ASX 300 Accumulation Index posted a reasonable gain of 10.19%; while the large market caps, comprising the S&P/ASX 50 Accumulation Index, performed even better, returning 11.55%.

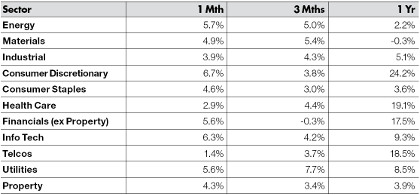

The best performing sectors in February were Consumer Discretionary, Information Technology and Energy. All three were strong performers, returning 6.7%, 6.3% and 5.7% respectively for the month.

The Telecommunications, Healthcare and Industrials were the worst performing sectors in February but, still increasing by 1.4%, 2.4% and 3.9%respectively.

Big movers this month

Going up: Consumer Discretionary: +6.7%

Going down: All sectors were positive for the month

Global equities

The MSCI World (ex-Australia) Accumulation Index was up 3.97% in February, reversing the sharp January downturn of 3.38%.

The US Dow Jones Index was up 3.85% in February. The strong price recovery in the broader S&P 500 Index, up 5.31%, followed the sharp share market decline in January.

The Nikkei has been a standout performer over the past 12 months, returning to 28.39% after being marginally down in February (- 0.49%).

European markets also performed strongly, as continued momentum and a broadening of the gradual economic recovery is evident across the smaller countries. The Euro 100 index rose by 4.02% in February. France was the standout performer, rising 5.52%, while Germany rose by 3.48%.

The UK was also up in February, with a strong rise of 4.69%.

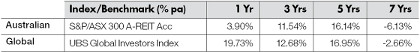

Property

In February, the S&P/ASX 300 A-REIT Accumulation Index posted an extremely strong 4.26% return, although underperforming the broader S&P/ASX 300 Accumulation Index.

On a 12 month rolling basis, property continues to underperform compared to the ASX 300 Accumulation Index. The S&P/ASX 300 A-REIT Accumulation Index was up 3.90% for the year to February, compared to the ASX 300 Accumulation Index’s rise of 10.19% for the same period.

Over the long-term, global property has continued to strongly outperform the Australian listed property sector. Global property, as represented by the UBS Global Investors Index was up 19.73% over the rolling one year period.

Fixed interest

US 10-year bond yields inched higher in February, to close the month at 2.68% (up 0.04%). Australian 10-year bond yields closed the month unchanged at 4.0%

Australian bonds were relatively subdued during February. For the month, the UBS Composite Bond All Maturities Index posted a return of 0.34%.

Global bonds, as measured by the Barclays Capital Global Aggregate Index, were a little weaker than Australia The unhedged index posted a -1.13% return for February, while the hedged equivalent had a marginally positive return of 0.67%.

On a 12 month basis, Australian bonds returned 3.07%, but underperformed relative to unhedged global bonds that were up 16.34%. Hedged global bonds were also higher returning 4.14%.

Australian dollar

In February, the Australian Dollar (AUD) increased 2.0% against the US Dollar (USD) to finish the month at 89.28 US cents. Over the past 12 months the AUD has declined significantly against the USD, down 12.61%.

The AUD was also up 2.10% against the Japanese Yen in February. On a 12 month basis, the AUD is down 3.52%.

Against the Euro the AUD was relatively flat, down only 0.27% during February, but is down 17.3% for the 12 month period. The AUD finished the month at €0.647.

The information contained in this Market Update is current as at 6/3/2014 and is prepared by GWM Adviser Services Limited ABN 96 002 071749 trading as ThreeSixty Research, registered office 150-153 Miller Street North Sydney NSW 2060. This company is a member of the National group of companies.

Any advice in this Market Update has been prepared without taking account of your objectives, financial situation or needs. Because of this you should, before acting on any advice, consider whether it is appropriate to your objectives, financial situation and needs.

Past performance is not a reliable indicator of future performance.

Before acquiring a financial product, you should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product.